Retirement Plan Contribution Limits 2025 Chart

Retirement Plan Contribution Limits 2025 Chart. For the 2025 plan year, an employee who earns more than $155,500 in 2025 would be considered an hce. Top 8 types of retirements plans in india are:

For the 2025 plan year, an employee who earns more than $155,500 in 2025 would be considered an hce. 2025 retirement plan contribution limits (401k, 457 & more) the information below summarizes the retirement plan contribution limits for 2025.

The Employee Contribution Limit For 401 (K) Plans In 2025 Has Increased To $23,000, Up From $22,500 For 2023.

The effective date for 2025 limits is january 1, 2025.

More Details On The Retirement Plan Limits Are Available From The Irs.

2025 contribution limits for retirement plans.

By Fisher Investments 401 (K) The Irs Determines How Much Individuals Can Contribute To Various Retirement And Pension Accounts.

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

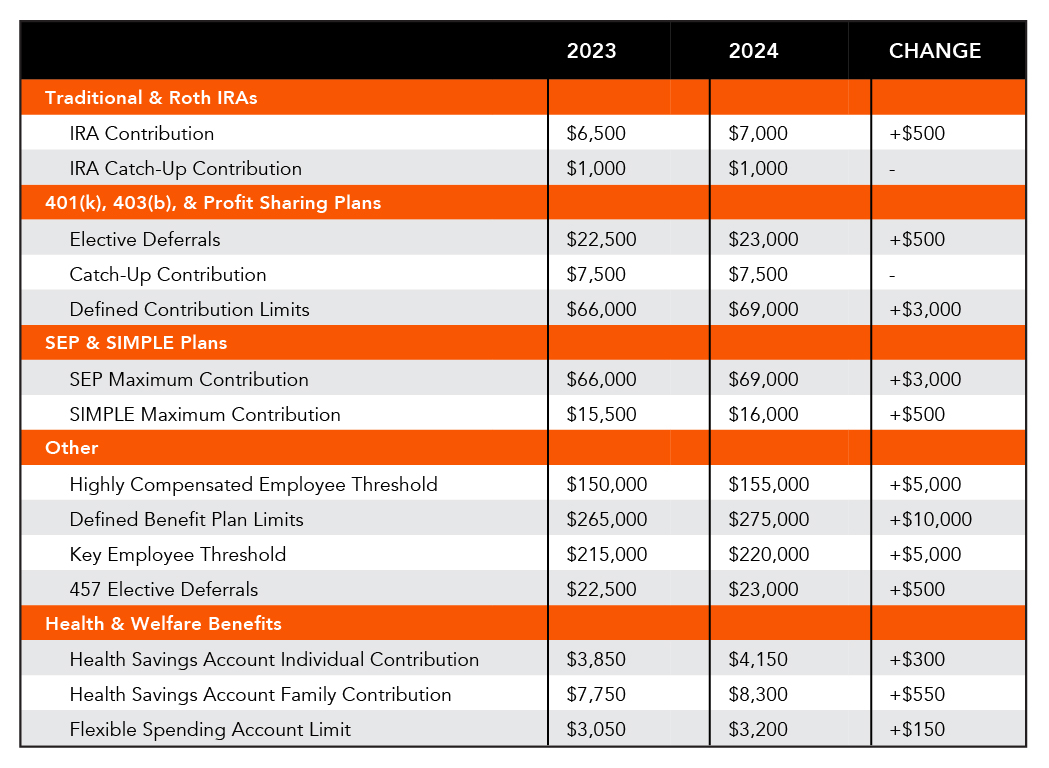

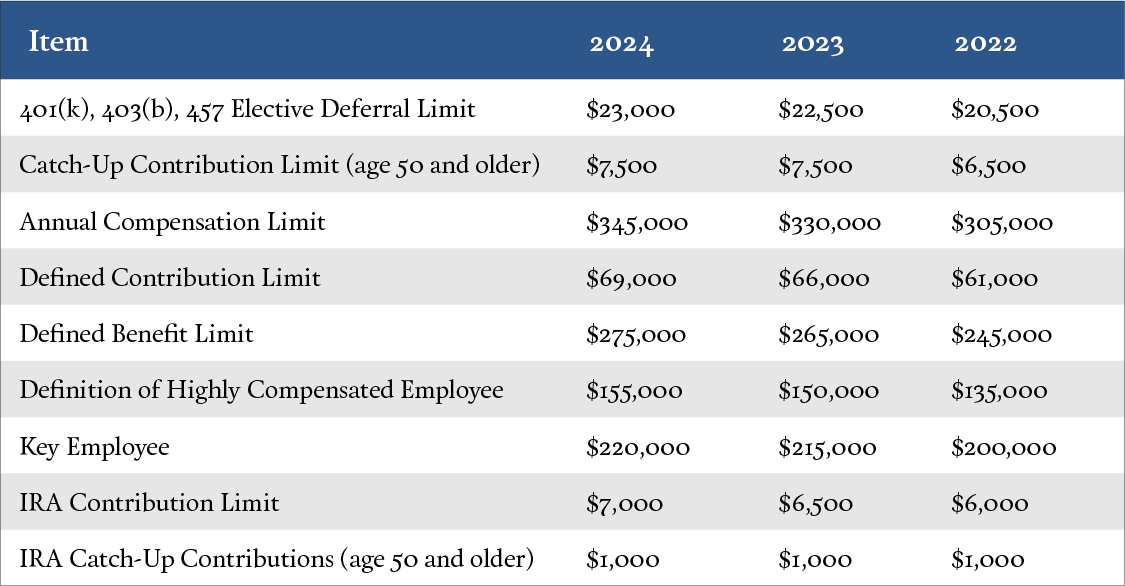

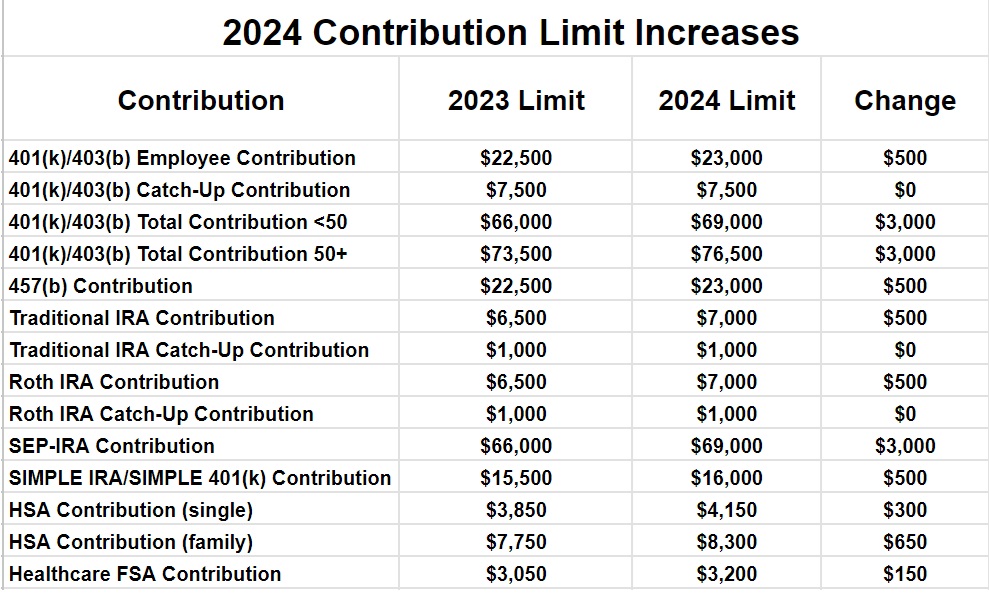

2025 Contribution Limits Announced by the IRS, The irs adjusts retirement plan contribution limits annually for inflation. Modified agi limit for traditional ira contributions increased.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), 2025 contribution limits for retirement plans. Retirement plan contribution and benefit limits.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2025 Retirement & Employee Benefit Plan Limits, This year you will be able to save more for retirement than ever before with increased salary deferral contribution limits for employee retirement plans. Irs releases 2025 retirement plan limitations.

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, 401 (k) pretax limit increases to $23,000. The irs released new limits for retirement contributions for 2025.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), How might this impact your plans? Maximum annual benefit limits for defined benefit plans will be $275,000, an increase of $10,000 from 2023.

What’s New for Retirement Saving for 2025? SEIA Signature Estate, The employee contribution limit for iras is increased to $7,000, up from $6,500. 2025 401(k) and 403(b) employee contribution limit the total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2025 (compare that to the $2,000 it increased.

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Simple Ira Contribution Limits 2025 Over Age 50 Katya Melamie, See what the current and historical retirement plan limits have been. Other key limit increases include the following:

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, Until then, here are the limits for 2025 retirement plan contributions, as verified by the irs. 2025 401(k) and 403(b) employee contribution limit the total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2025 (compare that to the $2,000 it increased.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

2025 Retirement Plan Contribution Limits, Without considering other adjustments, if you. The contribution limit to an individual retirement account (ira) is $7,000 (up from $6,500 in 2023).

Source: capstoneinvest.com

Source: capstoneinvest.com

2025 Retirement Plan Updates from IRS Financial AdvisorRetirement, The total contribution limit for defined contribution plans is $69,000 in 2025 (up from $66,000 in 2023). This chart lists the maximum amounts individuals are permitted to contribute to their retirement plans each year.

2025 Retirement Plan Contribution Limits (401K, 457 &Amp; More) The Information Below Summarizes The Retirement Plan Contribution Limits For 2025.

Without considering other adjustments, if you.

1, 2025, The Following Limits Apply:

Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).